How due process can stop the Council Tax racket

A summary of why Council Tax debt collection is unlawful, so demands reform

The growing public revolt against Council Tax racketeering in Britain is a principled one with many facets, but this just cause can be difficult to understand at first, especially for those from abroad. This convoluted property tax emerged in the early 1990s from the wreckage of the Poll Tax, a flat-rate regressive charge on each adult — for merely being alive. The Poll Tax turned out to be so unpopular that it caused riots, and was enough to unseat Margaret Thatcher, one of the most powerful politicians of the 20th century. Something else had to be invented to fill the gap in local government finances.

Council Tax is the hastily-implemented replacement for Poll Tax, being a complicated hybrid of a levy on the “roof over your head” (and its notional value) as well as the (number of) “heads under the roof”. It has many of the same flaws as the Poll Tax, in terms of law, morals, and execution. Council Tax is said to establish a “statutory obligation,” meaning an obligation to pay someone, which seems to emerge without a clear basis. It is not a bill, like for a utility service, so does not fall under the Bills of Exchange Act 1882, and does not represent a contract for service — it is “to someone”, not “for something”. There are controversies over the definition of the types of dwelling it applies to, and its lawfulness as a result of EU membership, but those are distractions in this context.

More seriously, by conjuring up a charge for the innate right to seek shelter, Council Tax substitutes a failed levy on breathing for one on staying warm and dry. “No matter what your circumstances, you need to go out and work for someone, and give away all the money you earn, in order not to be made cold, hungry, or homeless by violent force.” This is a form of bonded labour or debt slavery, and is immoral, being the typical behaviour of human traffickers. It is equally wrong when legislated into being, since we are not property of the state. Parliament is constitutionally constrained not to act to the detriment of the people, and coercing you to pay for inalienable rights is not within its delegated powers.

Are you obligated to pay Council Tax?

While there are constitutional and moral reasons to object to Council Tax, many who object to the charge have focused on the lawful obligation to pay. Conscientious objectors follow a procedure where they conditionally accept the council’s payment demand notice, and offer to pay subject to proof of the claim that you specifically are liable. There is a three-letter process you can go through called “estoppel”. If by the end the council has failed to provide proof that you are specifically liable to pay, then they are “estopped” from making this claim in court — so cannot pursue you for any debt.

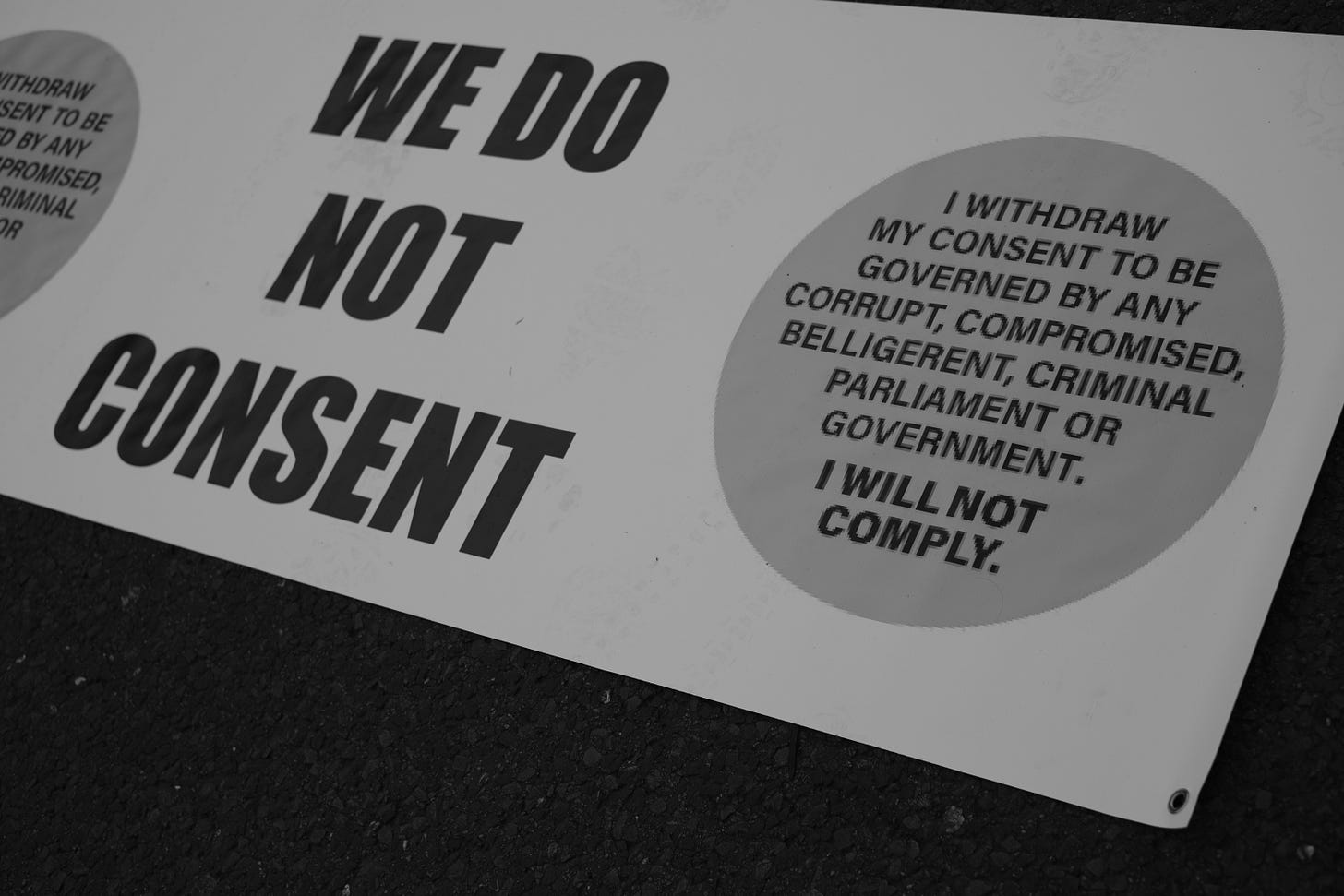

Invariably, they fail to prove that you have a lawful obligation to pay. This is because they cannot demonstrate that you have given lawful consent to the statutes they cite. Without the consent of the governed, there is no force of law. We are all equal under the law, and nobody is able to use legislation to coerce anyone else into acting. To believe otherwise is to give Parliament an unbounded and tyrannical right to force you to eat your broccoli and exercise daily. These are the “rules of equity” in play, being a superior form of law: Parliament cannot do to us what we cannot do to Parliamentarians.

This lack of lawful obligation to pay is reinforced by a case that went to the Court of Appeal in 2019, where it was ruled “no legal duty exists that requires a resident to notify a council of their residence at a particular address for council tax purposes” — even if you might imagine there was one. The logical consequence is that there is also no duty to give them the information they need to charge you for Council Tax, nor to enforce their alleged debt. There is no also law that states the general public must fund the pensions of civil servants, or cover redundancy payouts. Yet those without pensions are being forced to pay generous ones to councillors working for private corporations, under duress.

The Council Tax collection and enforcement process

There is nothing wrong with this “obligation to pay” approach, yet it does suffer from one weakness. In terms of optics, it may seem like you are “not doing your bit” to fund public services, and using a loophole to evade your civic duties. That may be materially false, but public perception does matter. It locates the issue in the specifics of one tax, and the complex legalistic arguments around it. In terms of delegitimising Council Tax in the court of public opinion, it is not the strongest card available. There is a trump card that shows how Council Tax goes against the most basic principles of natural justice. This reframes the problem away from the intricacies of Council Tax into a concern that everyone can relate to.

It does not matter whether you are an anarchist, libertarian, conservative, centrist, socialist, or radical: Council Tax has a flaw that is so universally damning that it cannot continue in its current format. That flaw is that it is constructed from its inception to lack due process in its debt collection workflow. This flaw cannot be resolved by a simple administrative change, since the tax as a whole is unlawful at every stage; the absence of due process is merely the capstone on the tomb of legalised theft. Specifically, if you ask to see the court-issued liability order against you as a Council Tax “debtor”, nothing with the authority of a genuine court of law imposing a real debt will ever appear, nor can it.

To understand why, it helps to understand how Council Tax liability orders are issued by administrative tribunals rather than traditional courts. These tribunals are not part of the regular court system, do not operate under the Civil Procedure Rules, and do not provide the same level of judicial oversight as traditional courts. They are creatures of legislation, but are unconstitutional. They lack the separation of powers of genuine courts, since they conflate the role of the complainant (the council) and judge. The standard of proof in council tax liability order proceedings is also generally lower than in criminal or other civil court cases.

Private tribunals that masquerade as public courts of law

The standard reference on the matter is Halsbury’s Laws of England, a reference tome which appears on every judge’s bookshelf. This says (2011) [my emphasis]:

The law is absolutely clear on this subject. There is no authority for administrative courts in this country and no Act can be passed to legitimise them because of the constitutional restraints placed upon her Majesty at her coronation. Her oath requires her to govern us according to our respective laws and customs, a vital part of which consists of the tripartite system of separation of powers between judiciary, parliament (legislature) and executive. The collection of revenue by administrators is extortion, and extortion has been found reprehensible since ancient times.

At this point Council Tax is clearly holed below the waterline. No matter what you believe about taxation’s role in a civilised society, it is wrong to operate courts that pretend to be lawful when they are not. Doing it with legislative or executive backing makes it a worse infringement of our rights, not better. This is why obligation to pay is not the basis for fighting the Council Tax racket, but due process is: no reasonable person can object to a desire for a lawful hearing that produces documentary evidence of its judgment. Without a paper trail from a court showing a liability order was issued, councils can make any claim for money they want against anyone.

You can tell that these courts are not constructed in a lawful way by how they operate. The unsigned summons appears to come from the court, but is actually from the council, which is fraud. They lack the appropriate seals or authority of a real court summons. There is no case number issued by the court, but is instead assigned by the council, so there is no case independent of the complainant. There is no formal public record you can examine. No order is sent by the court to the defendant, and there is no “liability order” form prescribed under Civil Procedure Rules or Criminal Practice Direction. No court stamp or seal is found on the resulting judgment. Hearings are notionally open to the public, but try getting into one — and they increasingly attempt to hold hem virtually, to stymie scrutiny.

Councils can never be courts of law

How come such a lack of impartiality can exist in what claims to be a court of law? What is effectively happening is that the council has “borrowed” the power of the court, to act as a court itself, in order to extort money from the public. The hearings also engage in a form of legal trickery to get the public to relinquish their status as trust beneficiaries and take on liabilities as trustees, but that is beyond the scope of this article, and due process is enough to end the racket. It is sufficient to note that the trickery depends on not having an honest judge who understands trust law. Furthermore, there is notorious cheating by councils on costs, with councils being caught out repeatedly in lawsuits, but the corruption continues anyway. The whole thing is a money-making scam.

When a council acts as if it were a court, it is explicitly breaking the law. The Local Government Act 1888 clearly states:

“…this Act shall not authorise any county council or any committee or member thereof… to exercise any of the powers of a court of record; …to exercise any jurisdiction under the Summary Jurisdiction Acts, or perform any judicial business, or otherwise act as justices or a justice of the peace”.

In other words, councils are colluding with magistrates’ courts, with the blessing of Parliament and the Ministry of Justice, in order to issue false paperwork, and commit fraud and malfeasance in public office. No wonder they don’t want to be held accountable with a signed and stamped court order! When the hearing is opened, the representative of the council swears that the sums presented are due. Given that no council has yet proven an obligation to pay for any natural person, and can only point to a generic legislative desire for payment, this is also perjury. Council tax debt collection is a criminal enterprise — with official sanction. That makes it one of the worst political scandals ever.

Justice demands a judicial mind be applied

Council Tax Liability Order proceedings often involve limited judicial involvement, or none at all. Some of these proceedings may be conducted entirely by administrative staff, and there may be little or no direct judicial oversight. Summonses are issued with no thought given to each case. This is unlawful, and case law supports this assertion, see Regina v Brentford Justices, Ex parte Catlin [1975] QB 4551:

“A decision by magistrates whether to issue a summons pursuant to information laid involves the exercise of a judicial function, and is not merely administrative.”

Where thousands of cases are processed in bulk, with no regard to any prior correspondence, or context, this represents a serious and major failure in judicial oversight according to Lord Justice Widgery:

“.... It must however be remembered that before a summons or warrant is issued the information must be laid before a magistrate and he must go through the judicial exercise of deciding whether a summons or warrant ought to be issued or not. If a magistrate authorises the issue of a summons without having applied his mind to the information then he is guilty of dereliction of duty and if in any particular justices’ clerk’s office goes on a practice goes on of summonses being issued without information being laid before the magistrate at all, then a very serious instance of maladministration arises which should have the attention of the authorities without delay...”

These administrative tribunals are operating so far outside of the law that they themselves are criminal in nature. Just the crime has become “official” since it makes money for the state and its agents.

A violation of our international treaty obligations

The council tax tribunals are effectively set up to find the public “auto-guilty”. Meanwhile, individuals involved in council tax liability order proceedings may not have access to legal representation, and legal aid is typically not available for these cases, which is problematic given the wobbly legal basis for the tax. Challenging a council tax liability order can be complex, and individuals may need professional help to navigate the administrative appeals process. Few have the energy and patience, so most people will fold and pay up.

These fake and unbalanced courts are rigged from their inception against the public. There are superior international laws that override parochial statute law, and these treaty commitments are being violated by this biased legal system:

European Convention on Human Rights (ECHR) Article 6(1): In the determination of his civil rights and obligations or of any criminal charge against him, everyone is entitled to a fair and public hearing within a reasonable time by an independent and impartial tribunal established by law.

International Covenant on Civil and Political Rights (ICCPR) Article 14(1): All persons shall be equal before the courts and tribunals. In the determination of any civil matter or of any criminal charge against him, everyone shall be entitled to a fair and public hearing by a competent, independent and impartial tribunal established by law.

Universal Declaration of Human Rights (UDHR) Article 10: Everyone is entitled in full equality to a fair and public hearing by an independent and impartial tribunal, in the determination of his rights and obligations.

What is particularly egregious is that the process creates a new kind of “debtor” outside of all existing civil debt procedures and unrecognised by any higher court, but with a fake “debt”. The secondary legislation states:

The amount in respect of which a liability order is made is enforceable in accordance with this Part; and accordingly for the purposes of any of the provisions of Part III of the Magistrates' Courts Act 1980 (satisfaction and enforcement) it is not to be treated as a sum adjudged to be paid by order of the court.

This literally states there is no sum for which you are liable! The “liability order” is essentially a license for the council to begin a process of harassment and intimidation — for a non-existent debt. It is very difficult to reconcile this with our human rights obligations, both in English constitutional law, as well as international law. The right to due process goes all the way back to Magna Carta in 1215, if not earlier, and is one of the most basic civil rights, even if the language of “due process” is modern. You might have thought the court process was the worst violation, but…

The downstream nightmare of “enforcement”

After the court hearing, the council will write to you with a “notice of liability order”. This could be read as a “rumour of a liability order”, so you are perfectly entitled to ask to see evidence of the order. They have made the claim that one exists, so it is elementary law that the onus is on them to prove their claim. Procedural due process also insists that you should have an opportunity to check whether an administrative error was made, the order is against the right person, the sum requested is correct, and the court was lawfully assembled. You can remain in honour by stating you will pay, subject to proof of claim being offered.

All of these matters will be ignored: the council will proceed with “enforcement”, because to acknowledge anybody’s request for due process would spell the end of the whole Council Tax scam. Since due process is not possible, as there was no lawful court, anybody could immediately halt the process of debt collection by putting the matter into permanent dispute. Without a functioning threat of debt enforcement, why would the average person strapped for cash pay their Council Tax? Also, it would draw attention to the criminal nature of the whole endeavour from its inception. Councils have only one option left: to try to railroad you into paying, no matter how unlawful their behaviour, so the racket is not exposed.

Having asked for due process, you will receive threats of removal of your goods, and visits to your home to impersonate bailiffs. This will even occur if you have removed the common law implied right of access, making each visit into the crime of aggravated trespass. You may receive texts, calls, letters — none of which will ever acknowledge your request for due process, or that the case is in legitimate dispute. You certainly will never, ever, get a proper liability order from a genuine court of law. The council may also steal from your earnings from your employer or state benefits, again overriding any request for evidence of a court order.

Third party debt collectors will be employed to harass you, and multiple ones, so you have to go through the stand-down process over and over. They will shamelessly violate your rights under data protection laws, and fabricate non-existent court orders on digital tablets. Your car may be unlawfully clamped, stolen, and sold — even if it should never be taken, for instance if you use it for your work. The requirement for debts to be lawfully transferred (using deeds of novation and assignment) will be ignored. This is pure gangsterism under the colour of law, but the police will do nothing to help you, claiming (falsely) it is all a civil matter.

Do we have the rule of law in England?

This all paints a bleak picture of the state of justice in England, but the situation is not hopeless. Higher courts are typically fairer, and pay heed to constitutional matters, as well as the rules of equity. Their defined processes and structures support a generic right to due process, albeit in indirect fashion. For instance…

Civil Procedure Rules (CPR): CPR Part 5 deals with court documents, and CPR Part 40 relates to enforcement of judgments and orders. These rules outline procedures for filing, serving, and accessing court documents, including orders. While they don't explicitly state a "right to inspect," they establish processes for parties to obtain copies of relevant documents.

Practice Direction 40E: This Practice Direction provides guidance on the enforcement of judgments and orders. It includes provisions related to the inspection of court documents. Parties enforcing judgments may apply to the court for permission to inspect specified documents, including orders.

The Overriding Objective: The "overriding objective" under CPR Part 1.1 is to enable the court to deal with cases justly. This includes ensuring that cases are dealt with fairly, efficiently, and transparently. Parties' access to relevant court orders and documents is consistent with this objective.

We also have case law that supports due process, such as Entick v Carrington (1765). This landmark case established the principle that state authorities cannot enter a person's property or seize their belongings without lawful justification. It affirmed the importance of individual privacy and protection against unreasonable searches and seizures, which is exactly what is happening with Council Tax. We have been here before in history, and won. The law is on our side, we just need to exercise it.

By demanding due process and the rule of law, and taking these matters to higher courts, we have an opportunity to push back against the blatant criminality of Council Tax debt collection. If you contact the Magistrates’ court and ask to see the order, you will be offered a paid certified computer printout, not a signed order with the Crown logo embossed. They are so brazenly unlawful that it cannot be hard to sue them for conspiracy to defraud. The onus is on us, the public, to educate ourselves and act.

A glimmer of of hope

A recent court win in a council tax case points the way. The case was decided on 21st September 2023 in the High Court, KBD Swansea in favour of a Mr Leighton. He was awarded £4,000 against debt collectors Bristow and Sutor, acting in alliance with City of York Council. The essence is that they were attempting an unlawful Council Tax debt collection process that failed to evidence the liability order, for which Mr Leighton was entitled to damages. Money talks, and when this scam is unprofitable for its agents, it naturally ends.

What is critical is less the precedent set, but rather the judge’s comments as reported by campaigner Mr Patterson on social media: “His Lordship Harrisson condemned the process of how Council Tax liability orders are obtained and held it is time for reform, concurring with my submission that the process raises issues under Article 6 ECHR. He also questioned their validity, holding that they don’t actually constitute a court order at all”. The higher courts are noticing that these rubber stamp courts are problematic, and will no doubt sense the threat to their own legitimacy if they give it a pass.

Council Tax liability orders are operating under an administrative framework that only provides “law theatre”. They are attempting to entrap living men and women, acting under common law, into maritime law, and trick you into accepting their liabilities and liens. The whole process is treasonous, and bears the highest level of criminal penalties as a result. Until we see a paradigm change in our system of law and government, it is our duty to push back using the tools at our disposal. We can no longer afford to remain passive in this matter.

Due process is the weakest point in Council Tax, as it is very simple to understand — “show me the court order you claim exists”. We now have proven it is a winning strategy in court, too. It aligns both the public perception with the legal problem, and avoids getting mired in complex issues of jurisdiction, trust law, and legislation. The job is to delegitimise both the unlawful tax, and those who enable its collection via criminal means. All we have to do is insist on lawfulness, and protest loudly when it is missing — so this becomes a mass movement for justice.

Superbly written, so eloquent and educational. I have forwarded it to many...

Perfect timing too, I have a case against the council and they are criminals....no other word for it..

Love how the deep dives and *courageous* persistence have overcome inertia and the proverbial ball seems indeed to be rolling downhill.

HOORAY!!!!

(hasn't Q said something about the law being key . . .)

=;-)