Is my car a cake or a biscuit?

An interesting tribunal precedent that most of my readers won't know about

This morning I drove my brother from Staines to London’s Heathrow Terminal 5, and in doing so I entered into the dreaded Ultra Low Emission Zone (ULEZ). Transport for London would like to charge me £12.50 for ULEZ (applies to all vehicles) and £100 for the Low Emission Zone (LEZ) that applies to commercial vehicles, as it presumes my Ford Escort van is commercial in nature. £112.50 in GBP is around $140 in USD, which is a lot of money for a two mile round trip, and is about 5% of the resale value of my car! It is a form of entrapment, as there is no alternative “long way round” highway, unlike a toll bridge or tunnel.

Naturally, I will be fighting this, as the presumption that my “car derived van” is commercial in nature is false; it is my private carriage for my person travel, and insured only for social, domestic, and pleasure use. The whole of ULEZ is unconstitutional and treasonous, as it trashes our common law right to travel on the public highway, but arguing that in a tribunal or court right now won’t get you anywhere. What does look bad is being discriminatory, and I am being discriminated against because of the looks of my car, which have nothing to do with its emissions. I am fighting a comparable form of discrimination by Newcastle City Council, and the traffic penalty tribunal hearing is set for 31st January.

As part of my research I have been reminded of what is perhaps the most famous administrative tribunal ruling in English law, which happened back in 1991. On one side was McVities, part of a large processed food conglomerate, United Biscuits. One the other was Customs and Excise, an ancestor of HMRC (the British equivalent of the IRS), who regulated sales tax. The taxman’s contention was that Jaffa Cakes were chocolate-covered biscuits (i.e. a cookie in American English, nothing to do with what you Yanks call a biscuit). As a luxury biscuit, they were subject to value-added tax at its highest rate, whereas cakes counted as essential items and were zero-rated.

Now, for my largely American audience, the cultural significance of Jaffa Cakes in Britain needs spelling out. You have Oreos, Reese's peanut butter cups, and Fig Newtons as your staple semi-poisonous treats. Here we strictly raise our children only on cookies coated in chocolate — you can be imprisoned for feeding them unprocessed foodstuffs like broccoli. The crack cocaine, crystal meth, and heroin of these are respectively Jaffa Cakes, Hob Nobs, and Digestives, with the signature brands all being owned by the venerated McVities. When the taxman comes after Jaffa Cakes, this is an assault on our fundamental way of toxic living.

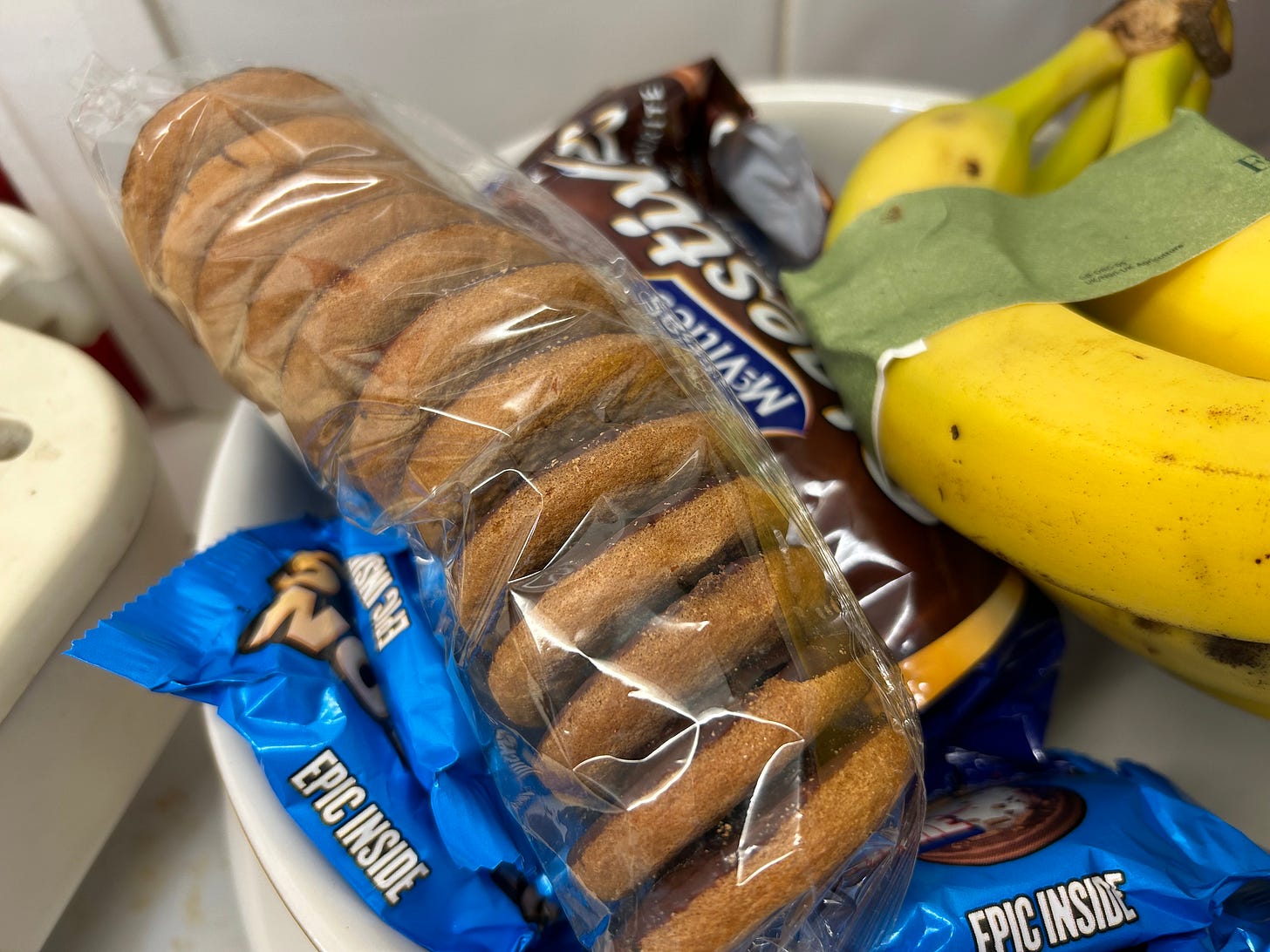

To drive the point home, the header image is from my parents’ house right now, where there are rapidly disappearing chocolate Jaffa Cakes overlaying some less sought after chocolate Digestives, on a foundation of chocolate Wagon Wheels, garnished with bananas for decoration, as nobody ever eats fruit when they have sugar bombs in the kitchen. It’s the law: if you have your children in the house, no matter what their age, you must have chocolate-coated diabetes precursors in stock. There may be adults in the United Kingdom who did not consume Jaffa Cakes as part of their British cultural training, but they probably all end up in mental institutions and are rightly shunned by mainstream society.

The taxman controversially argued that iconic Jaffa Cakes were made by a biscuit company, packaged like biscuits, sold on the same shelves as biscuits, and looked like chocolate biscuits. They conducted a consumer survey, and asked people whether they were cakes or biscuits, and the majority said they were biscuits. They were also the size and shape of biscuits (and not a slice of cake), were eaten in the same manner as biscuits (by hand, not fork), so surely they were biscuits? Well, it turns out that it wasn’t quite so clear-cut.

Jaffa Cakes are made from a batter that more closely resembles cake than a biscuit. They are soft like cakes, and break apart in the same way. Crucially, they also aged like cake, going hard when stale, rather than soft like a biscuit. While all the factors listed earlier pointed to Jaffa Cakes being a biscuit, these were only the surface matters of form. When it came to the literal substance, there was no doubt that Jaffa Cakes were cake, as the name suggests, and not biscuits. On this basis, the tribunal ruled that Jaffa Cakes, being cake, should be counted as essential items and not subject to VAT. This made national newspaper headlines at the time.

In law, the rules of equity tell us to prefer substance over form, since this is fairer and more just. We try to adhere to the fundamental true intent and purpose, elevate rationality and morality above mindless enforcement of policies, and by default avoid the creation of legal fictions detached from material reality. This VAT tribunal over thirty years ago was implicitly applying core principles of equity, which limit the powers of the legislature and executive every bit as much as international treaties and constitutional law.

This decision had significant implications for tax purposes and highlighted the importance of precise classifications in tax law, often with seemingly trivial items becoming the focus of legal scrutiny. This brings me back to my own Ford Escort van. Is it a Ford Escort (the “cake” not subject to tax), or a van (the biscuit that gets hammered by the taxman)? Its substance — the chassis, engine, transmission — is clearly identical to any other Ford Escort. Only its form differs, being a van, not an estate, saloon, or hatchback. That means charging me the LEZ fee of £100 is unlawful, since it is discrimination on the basis of something (the shape of my car) unrelated to clean air.

That both the legislature and executive are bound by the rules of equity was reinforced in 2019 by the UK’s Supreme Court. They ruled that Boris Johnson could not “prorogue” (i.e. dissolve) Parliament on the basis that if he could do it, us being equal under the law, meant anyone could. Since you and I cannot, nor could Boris Johnson, who is our peer in law. Furthermore, the Supreme Court reaffirmed that the Bill of Rights 1688 was still very much in force. This “constitutional” legislation (an oxymoron, but never mind) in theory prevents Parliament doing anything to the detriment of the people, like charging you for the disapproved shape of your carriage on the highway.

I happen to have a corner case where the legislation is creating privileged and punished classes of traveller, and I am in the tiny punished minority of people who use the van model of a car as their private transport. Pushing back and insisting on equitable treatment is a test of whether these administrative tribunals and lower courts are following the law, in its highest form. Or are they merely rubber stamping the lowest forms of legislation and policy, being process quality control for a taxation system run amok? Few can risk the costs of higher chancery courts where equity and constitutional arguments are typically heard.

In summary, the “ingredients” of my car — how is it constructed — are the same as LEZ exempt vehicles. The “decay product” of my car (its exhaust) is identical to LEZ exempt vehicles— in the manner that a Jaffa Cake “decays” like a cake (car), not a biscuit (heavy goods vehicle). How it is “consumed” (social use) is the same as LEZ exempt vehicles. How it was sold, marketed, or previously used are not a basis on which to discriminate against me. Private travel in a personal carriage is an “essential” right, and is not a “luxury” for-profit commercial enterprise.

It is obvious that my car is a tax-free cake, and not a taxable biscuit! Let’s see if this sticks in court…

This is all so F.. stupid my soul is starting to leave my body...

Your vehicle like mine has an MOT (unless MOT exempt) which is the accepted standard for being roadworthy in the UK, nowhere does it mention "zone dependant"

Ulez like C19 and so much else is a scam that we finance through taxation.💉😷☠️👎👍